Learn how cryptocurrency and blockchain technology are transforming the financial landscape. Discover the key concepts, benefits, and challenges of this digital revolution.

Introduction

Cryptocurrency and blockchain technology are reshaping the global financial landscape, offering an exciting alternative to traditional banking systems. With the rapid rise of digital currencies like Bitcoin, Ethereum, and others, the buzz around this new-age technology continues to grow. But what exactly is cryptocurrency, and how does blockchain technology work? Let’s dive into these revolutionary concepts and explore their potential for the future.

What is Cryptocurrency?

Cryptocurrency is a digital or virtual currency that uses cryptography for security. Unlike traditional currencies governments issue, cryptocurrencies are decentralized and run on blockchain technology. The most popular and well-known cryptocurrency is Bitcoin, but there are many others, including Ethereum, Litecoin, and Ripple.

The main appeal of cryptocurrency is that it is decentralized, meaning no central authority, like a bank or government, controls it. Instead, transactions are validated and recorded on a decentralized public ledger called the blockchain, ensuring transparency and security.

What is Blockchain Technology?

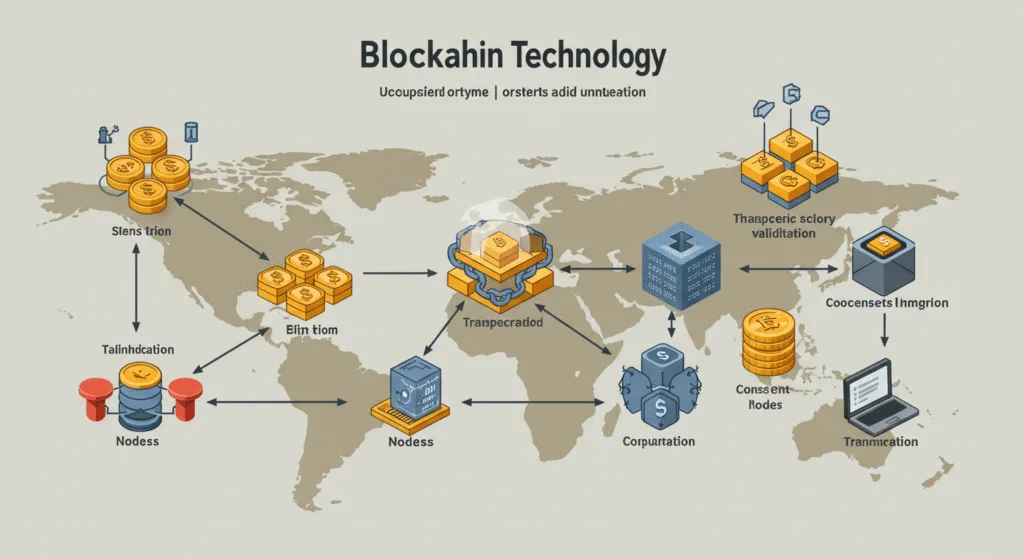

At the core of cryptocurrency lies blockchain technology, a revolutionary system that powers digital currencies. A blockchain is a distributed database or ledger that records transactions across many computers. This ensures that the information is secure, transparent, and immutable, meaning it cannot be altered once it is added to the blockchain.

Each transaction or data exchange on a blockchain is grouped into blocks and added to a chain, forming a blockchain. This secure process prevents unauthorized changes, making it highly reliable for industries beyond finance, such as healthcare, supply chain, and voting systems.

How Does Blockchain Technology Work?

- Transaction Initiation:

When a user initiates a transaction (e.g., sending cryptocurrency), the transaction is broadcast to a network of computers called nodes. - Transaction Validation:

Nodes verify the transaction’s validity using complex cryptographic algorithms. - Block Creation:

Valid transactions are grouped into a block and added to the blockchain. - Consensus Mechanism:

Through a consensus mechanism like Proof of Work (Pow) or Proof of Stake (PoS), the network of nodes agrees on the block’s validity, ensuring its immutability. - Finalization:

Once a block is validated, it is added to the blockchain, and the transaction is complete.

Benefits of Cryptocurrency and Blockchain Technology

- Decentralization:

Unlike traditional banking, cryptocurrency is not controlled by any single entity, making it more secure and less prone to censorship. - Transparency and Security:

Blockchain provides transparency by allowing all participants to view the transaction history. Its encryption methods ensure that the data is secure. - Low Transaction Fees:

Traditional financial systems often charge hefty fees for transactions. On the other hand, cryptocurrency transactions typically have much lower costs, especially for international transfers. - Faster Transactions:

Cryptocurrency transactions can be processed in minutes, even for international payments, compared to the days traditional banking systems require. - Accessibility:

Anyone with internet access can participate in the cryptocurrency market, which offers financial inclusion to the unbanked or underbanked.

Challenges of Cryptocurrency and Blockchain Technology

- Volatility:

Cryptocurrencies, especially Bitcoin and Ethereum, are known for their price volatility. This can deter some investors or users from fully embracing the technology. - Regulation:

Governments are still trying to figure out how to regulate cryptocurrencies. While some countries have embraced it, others have imposed strict regulations or banned it entirely. - Scalability:

While blockchain technology is powerful, it faces challenges in scalability. As the number of transactions increases, the network may slow down or face higher fees. - Security Risks:

Despite their security features, cryptocurrency exchanges and wallets are vulnerable to hacking. Users need to be cautious and adopt best security practices.

How Cryptocurrency and Blockchain Are Transforming Finance

Cryptocurrency and blockchain technology are driving innovation in the world of finance. The rise of Decentralized Finance (DeFi) is one example of how blockchain is providing alternatives to traditional financial systems. DeFi applications allow users to lend, borrow, and trade cryptocurrencies without relying on banks or financial institutions.

Moreover, blockchain technology improves transparency and reduces fraud in the insurance, real estate, and supply chain management industries. By leveraging blockchain, businesses can track the provenance of goods and services, ensuring authenticity and reducing fraud.

Conclusion

Cryptocurrency and blockchain technology are not just passing trends but are reshaping how we think about money, security, and transparency. As more industries explore blockchain’s potential, the digital revolution is only beginning. Whether you’re an investor, entrepreneur, or simply curious about the future of finance, staying informed about cryptocurrency and blockchain is key to understanding the changes happening in the global economy.

Read This Article: Unlocking the Mysteries of PI Coin